The Battle for Pegged Asset Trading

Dear readers! As many of you know, liquidity management is both my passion and my profession. In this article, I’d like to revisit the basics and offer a concise look at the evolution of pegged asset trading. By examining liquidity structures and platforms best suited for these pairs, we’ll deepen our understanding of the core concepts that remain critical in the space today. Along the way, we’ll also spotlight two of the year’s most compelling new liquidity solutions—Fluid DEX and EulerSwap—that truly deserve the industry’s attention.

The Early Days of Pegged Asset Trading (2018-2019)

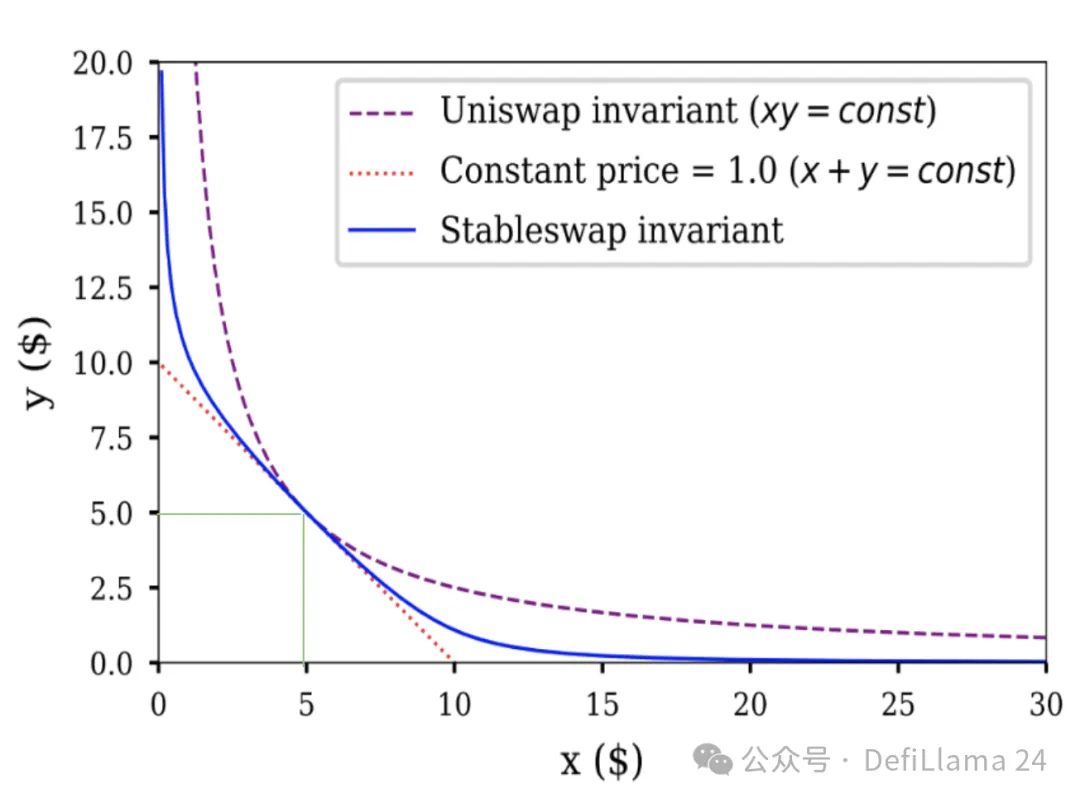

Just over five years ago, the only mainnet trading platforms were Uniswap, Bancor, and a handful of clunky order book-based decentralized exchanges (DEXs) like EtherDelta. Pegged asset trading choices were extremely limited. For example, using Uniswap V2’s USDC/USDT pool was standard practice—an approach that in hindsight was almost reckless. Let’s focus on this period to appreciate the inefficiencies it introduced. For liquidity pools, the key metric is the relative price movement between two assets: if you’ve ever provided liquidity (LP) for a volatile pair, you know the challenge. Take LINK/ETH, for instance: if ETH surges while LINK plummets, you end up with fewer ETH (the appreciating token) and more LINK (the depreciating one). But with USDC/USDT—two assets that are highly correlated—even their largest recorded divergence (the USDC SVB depeg) only saw a price gap of about 10%; under normal conditions, their difference is rarely more than a handful of basis points. Still, Uniswap V2 spreads liquidity across an extreme price range, allocating equal value everywhere from 1 USDC = 0.0000000001 USDT to 1 USDC = 10,000,000,000,000 USDT. In practice, 99.9% of USDC/USDT pool liquidity would never be tapped. The inefficiency is clear from the following chart:

x*y=k vs. StableSwap

The only liquidity that actually matters (assuming 1 USDC ≃ 1 USDT) sits where the two green lines intersect—a tiny sliver of the overall curve.

In contrast, the blue area on the same chart shows how StableSwap allocates liquidity for stablecoins. For assets with similar prices, the curve covers a much broader, more useful range than Uniswap’s invariant formula.

StableSwap: The Pegged Asset Revolution (2020)

The launch of StableSwap led to a massive migration of stablecoin liquidity, due to its efficiency—over 100x greater than Uniswap V2. StableSwap was the first appearance of concentrated liquidity on mainnet, predating Uniswap V3. Comparing them isn’t straightforward: Uniswap V3 is more flexible, while Curve’s StableSwap is laser-focused. Both deserve credit. Beyond efficiency, Curve implemented an incentive model—veCRV plus CRV rewards—a topic we’ve covered often. Incentives are vital for pegged asset pairs because they have unique features: overall trading volumes are usually lower than volatile pairs, and LPs can only collect very modest fees (until recently, volatile pairs charged 0.3–1% per trade, but pegged pairs were stuck at 0.05%). Volume often spikes only during special events (e.g., USDC’s depegging saw its all-time biggest day). For all these reasons, I long believed incentives were even more crucial for pegged pairs than for volatile ones. But with the arrival of Fluid DEX and EulerSwap, my view has changed. Before exploring these new entrants, let’s review another key milestone: the launch of Uniswap V3.

Uniswap V3 Brings Concentrated Liquidity (2021)

Uniswap V3 introduced fully customizable, concentrated liquidity for almost all asset types, sharply boosting LP efficiency. But since it works for more than just pegged pairs, the flip side is that LPs for volatile assets face even more significant impermanent loss risk. Given how ground-breaking it was—and the early lack of supporting infrastructure—adoption was initially slow. Customizable concentration proved a real breakthrough, especially for “loosely pegged” assets: think wstETH/ETH (highly correlated, but wstETH trends upward relative to ETH), or LUSD/USDC (correlated, but sometimes trades above or below the peg). In these instances, Uniswap V3 lets LPs replicate the high efficiency of Curve’s StableSwap, while tailoring distribution to market movements. This was a leap forward. Still, the next real inflection point arrived years later with the debut of Fluid DEX and EulerSwap.

Debt-as-Liquidity Solutions (2025)

To keep things concise, I won’t detail the Fluid and EulerSwap models here. Instead, let’s focus on why they’re so significant for liquidity design. Fluid pioneered a system where “Smart Debt” converts borrowing into liquidity. Picture an average user posting ETH as collateral and borrowing USDC. Do they care about receiving only USDC? Not really—they just want a safe, USD-pegged stablecoin. USDT would work just as well. Smart Debt makes this possible. In these vaults, borrowers receive a blend of USDC and USDT, with the mix continually shifting: the borrower’s debt itself now becomes liquidity for the USDC/USDT pool. For borrowers, this means lower borrowing costs, as they can earn trading fees that often offset interest.

That’s the borrower’s view. Now, from a protocol perspective: what’s the impact for Circle and Tether? In essence, it means near-zero cost liquidity with no external incentives required. For Circle—long supported by the broader ecosystem—this isn’t new. But for stablecoins like GHO, BOLD, or FRAX, it’s transformative. My focus here is on Fluid, but EulerSwap’s concept is similar (though with a different design). EulerSwap is still in testing, but it’s already posting significant USDC/USDT volume. If you understand this, my thesis is clear: “In DeFi, pegged asset trading will ultimately be dominated by Euler, Fluid, or equivalent protocols.” If this seems unclear, remember: pegged pairs usually have low volume and fees, requiring heavy incentives on legacy DEXs to maintain liquidity. Fluid and Euler can maintain that liquidity at almost no cost. If (as is already happening) pegged pair fee wars erupt, traditional DEXs simply won’t be able to compete.

0xOrb: An Emerging Challenger (ca. 2026)?

For a complete view, there’s another yet-to-launch but intriguing project: 0xOrb. The pitch is direct—stablecoin trading supporting n tokens, where n could reach 1,000. Think: a massive pool of USDC and USDT, slowly expanding to include “alternative” stables, offering deep liquidity between these and the major coins. This model benefits long-tail pegged assets, but I doubt these pools will ever dominate major volume (like USDC<>USDT or cbBTC<>wBTC). These pools can even support cross-chain swaps, but I see little upside here—the added infrastructure risk and complexity just isn’t worth it, especially now that tech like CCTP allows near-instant 1:1 USDC and USDT transfers cross-chain.

What’s the upshot for today’s pure DEX operators?

Most critically: we’re talking about pegged trading pairs. Replicating these models for volatile pairs is extremely difficult—as evidenced by losses suffered by Fluid’s Smart Debt + Collateral ETH/USDC vault and its LPs. DEXs like Aerodrome, where most activity centers on volatile pairs, will likely feel little impact. But for DEXs focused on pegged assets, the threat is existential. To wrap up, let’s consider two such examples:

Curve: Game Over Without Major Overhaul

Pegged asset trading remains at Curve’s core; it’s still the go-to venue for stablecoin liquidity. While Curve tried (and failed) to capture volatile asset volumes with CryptoSwap, the arrival of Fluid and EulerSwap puts Curve in real danger of losing market share. I don’t see Curve maintaining meaningful volume (in fact, it’s already out of the top 10) unless it makes significant changes: overhaul veCRV to optimize CRV incentives (learning from models like veAERO), use crvUSD to unlock DEX efficiency (e.g., enabling LPs to borrow crvUSD), and develop new liquidity mechanisms for volatile assets to capture more trading activity.

Ekubo: The Confident Newcomer on the Brink

Ekubo faces even graver challenges, being a much newer player. On the surface, it’s a surging Ethereum DEX with robust trading volumes. It’s essentially a Uniswap V4 alternative with more ways to structure liquidity and less fee extraction by the DAO than Uniswap (though the industry bar is already low). The issue: over 95% of volume is in USDC/USDT, with a razor-thin 0.00005% fee and heavy incentives. Ekubo is waging a price war it can’t win: it simply can’t sustain such low fees (LPs need a return), while Fluid and Euler can (since even earning 0.1% via Smart Debt is an improvement for participating borrowers).

Ekubo statistics as of July 7, 2025: $2.6 million TVL, roughly $130 million daily trading volume, just $662 in daily fees, with about 8% incentivized via EKUBO. They’re already hitting their platform capacity limit. Ekubo started this “fee war” with their USDC/USDT rates, but they are likely to be disadvantaged by their own fee structure. DeFi never ceases to surprise. As always, I hope this piece offers new perspective and deepens your understanding of the pegged asset landscape. I fully expect the Ekubo community to criticize me for expressing fact-based opinions—those reactions only reinforce my confidence. I’ve seen it all before: I called out MAI’s flawed security—soon after, it was hacked and lost its peg. I flagged R/David Garai’s manipulation and lies—within six months, R was hacked and all but disappeared. I criticized the Prisma team—within a year, their protocol was hacked and shut down. The list goes on.

Disclaimer:

- This article is republished from [tokenbrice], with copyright retained by the original author [tokenbrice]. For any concerns about republication, please contact the Gate Learn Team. The team will review your request in accordance with established procedures.

- Disclaimer: The views and opinions expressed in this article are solely those of the author and do not constitute investment advice of any kind.

- Translations into other languages are provided by the Gate Learn Team. No translated version may be copied, distributed, or plagiarized unless Gate is clearly credited.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge